Umair Haque, whose commentary I enjoy very much, has a ranting post in reaction to what he calls the continued looting of the society thorough tthe current bailout plans. He's got a great point in the lack of disincentives in the current financial set up:

To make better bankers, we have to give bankers disincentives.

Disincentives might revolve around the idea of liability, for example.

Doctors face a personal liability because of the human costs they might

impose. Bankers could too, given the clear and clearly massive costs

they're imposing on the rest of us.

Here's another kind of disincentive of a much more radical kind:

auctioning trading seats. If we auctioned seats on the trading desks of

the big banks, the problem of adverse selection would magically go

poof. Why? Because the bid price of a seat would rise to match the

expected value of benefits from trading, counterbalancing those

benefits, and diluting the incentive to loot.

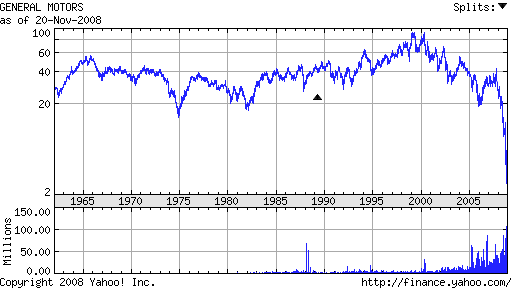

For example, NYSE seat prices rise and fall with equity values – and

it's no coincidence that the bulk of fraud and deceit happened at

banks, not on exchanges. Auctioning trading seats in general would

offset massive bonuses with equally massive disincentives to loot.

I hear he'll be visiting Istanbul in April to participate in a conference. I'm excited to get the chance to meet him.