Dave McClure has a fun recent post/rant on business models. In it, he makes a simplification:

Dave McClure has a fun recent post/rant on business models. In it, he makes a simplification:

Well because as we transition to a Startup Ecosystem driven by direct

payment & subscription business models, i want to make it clear how IMPORTANT it is to make sure users don't forget their passwords. If they forget their password, and/or can't recover it, then guess what MoFo — YOU DON'T GET PAID.

While I agree with his point, he then goes on to assert that the frequent-use models don't have this problem and therefore should win the transactions/subscriptions business models, which is where I start to get question marks. He provides examples from his tenure at PayPal and concludes that since Facebook and Google are the most frequently used properties, this is their game to use.

I also agree with the last point. However, I think it's a gross simplification to tie the causality to frequent use. It's the identity layer that counts. Not the frequency. I play some casual games daily. but they don't know about me nearly as much as Google or Facebook does. It's that intimate knowledge of who I am that counts!

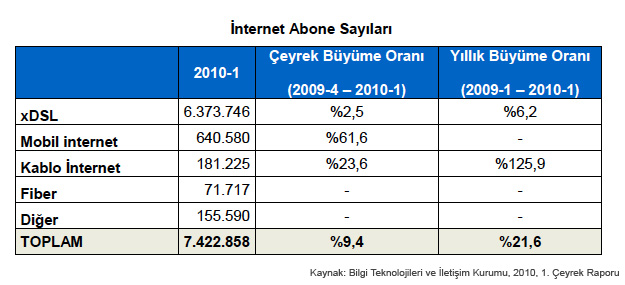

TBI Research is pointing out the revenue potential demonstrated by some recent data at Facebook through payments. It's not surprising that the results are positive. Payments are directly tied to identity. PayPal is under huge threat here. In fact, once the payment structures start to slip, eBay will be under threat as well.

The identity layer is enormously valuable. The biggest contenders for it are Google (because of Gmail) and Facebook. The identity layer will allow these companies, as well as those who will be able to grab a piece of it, to challenge some very large internet commerce areas. Payments are a great candidate. Others will be classifieds & listings, and loyalty programs.

I think there still is an opportunity in the Turkish identity layer, despite Facebook's domination here. Not sure how one should play it but I continue to think about it.